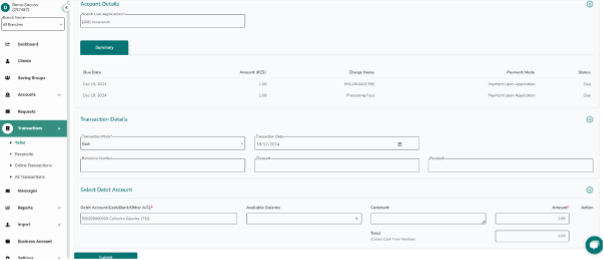

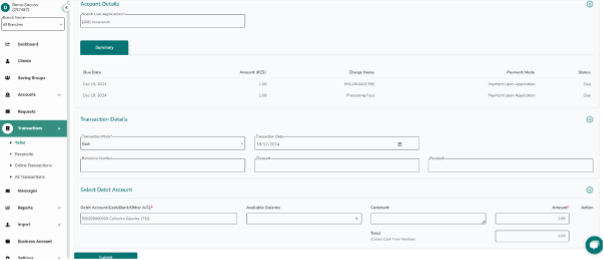

Multiple Fees per Loan Application

This can be achieved through the Teller functionality.

The Teller can add and repay multiple fees in one transaction via the teller module hence streamlining the fee management processing.

This can be achieved through the Teller functionality.

The Teller can add and repay multiple fees in one transaction via the teller module hence streamlining the fee management processing.

Now we have easy access to quick loan through a very visible section in the Wakandi Member App. By just a click of a button(s), and you’re good to go. The SACCOs/MFIs have to choose eligibility filters for their members to be able to experience this improved feature. Below are the steps you can follow…

We can be able to access these feature changes by logging into Wakandi admin panel, clicking onto Accounts then accounting from the side menu. Then choosing the Reports tab to access a drop down list of the reports. In the screenshot below, we chose the Owner’s Equity report then clicked into Options to reveal a…

This new report offers a segmented view of revenue contributions, empowering branch managers and the executive team to make data-driven performance evaluations and strategic decisions. The income report provides detailed insights into income generated by each loan officer and branch.

Backdated loan disbursements now shows the correct date in CAMS ensuring loan repayment schedule accurately reflects backdated transactions. The DEMO below will show the steps too (especially when viewed in fullscreen). The following are the steps on how to execute the new feature;

You can now download a report of all pending loan applications, regardless of their stage, in PDF, CSV or Excel format. This enhancement ensures easier tracking and processing of loan applications, streamlining your workflow and improving efficiency!

The following are the steps taken to download the statement from WBA.