Unclose Loan Feature

The “Unclose Loan” feature in Wakandi provides valuable advantages for SACCOs and MFIs by allowing admins to make necessary loan adjustments after a loan has been closed, without disrupting financial records.

Benefits

1. Flexible Loan Adjustments

- Reason: Admins can now adjust loan repayments or reverse transactions even after the loan has been closed.

- Value Add: This ensures that any discrepancies or required changes can be addressed without needing to reopen or restart the entire process.

2. No Impact on Ledgers

- Reason: Adjusting a loan after it has been closed does not affect the accounting ledgers.

- Value Add: This maintains the integrity of financial records, reducing the risk of errors or discrepancies in accounting systems.

3. Easy Re-closure After Adjustments

- Reason: Once the necessary corrections are made, the loan can be re-closed for finalization.

- Value Add: This provides a smooth, seamless process where loans can be accurately adjusted and then properly finalized without unnecessary complications.

4. Improved Accuracy

- Reason: The ability to unclose a loan allows for better management of loan data, ensuring all repayment or reversal details are correct.

- Value Add: Admins can ensure that all loan adjustments are made in a controlled manner, resulting in more accurate loan records and financial reporting.

5. Enhanced Workflow Efficiency

- Reason: By providing a feature that allows adjustments after loan closure, it streamlines the loan management process.

- Value Add: This reduces the need for workarounds or manual interventions, improving the overall efficiency of loan management workflows.

The Unclose Loan feature adds significant flexibility, accuracy, and efficiency, making it a powerful tool for managing loan adjustments while maintaining clear and accurate financial records.

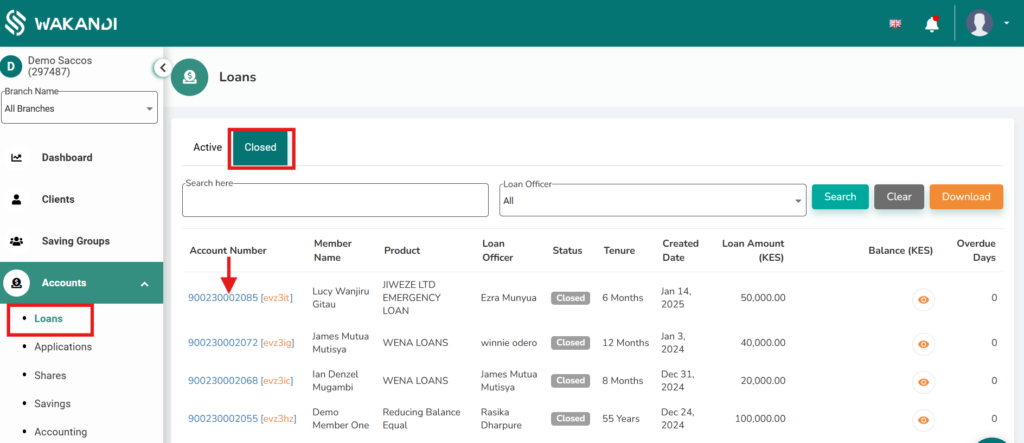

Steps to Unclose a Loan:

- Select a Closed Loan: Find the loan you wish to unclose.

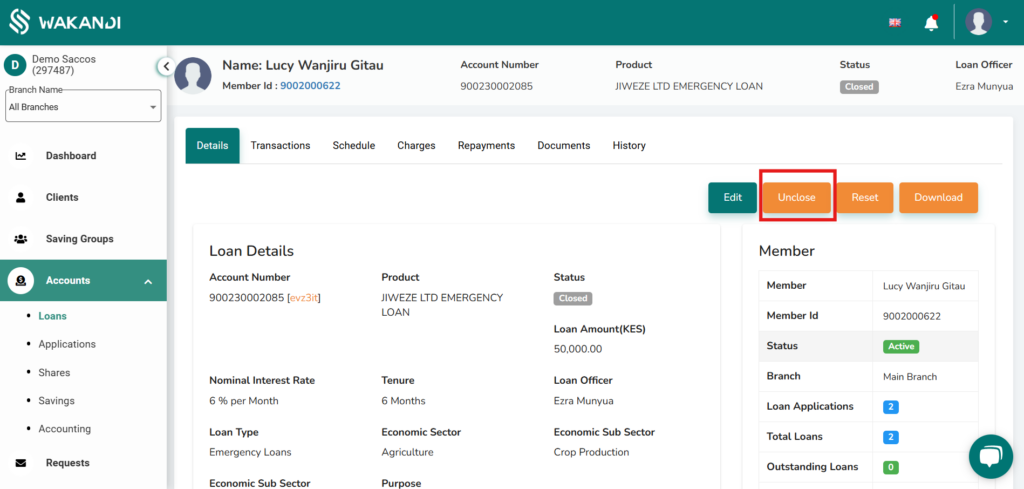

2. Click on the “Unclose” Tab: Select the “Unclose” tab to proceed.

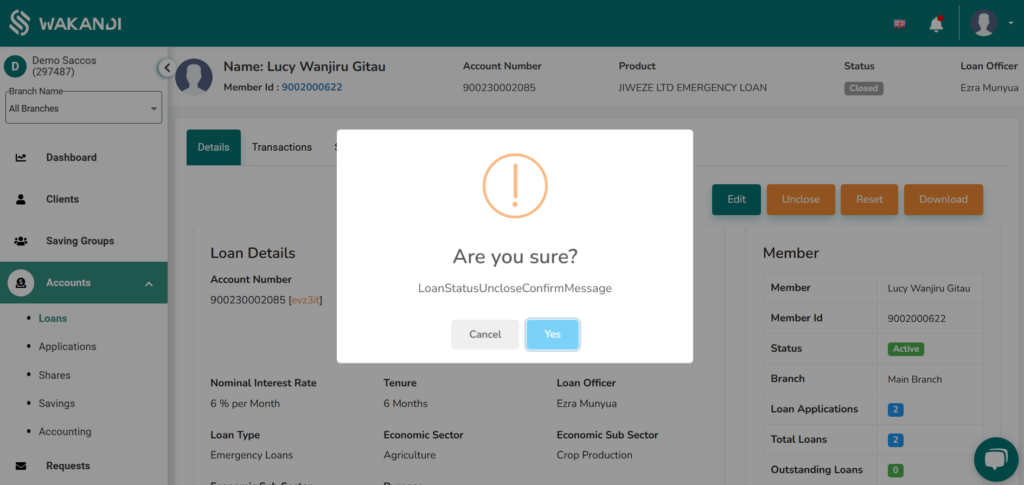

3. Confirm and Make Adjustments: Confirm the unclosure and carry out the necessary corrections.

4. Re-close the Loan: Once adjustments are complete, re-close the loan to finalize.