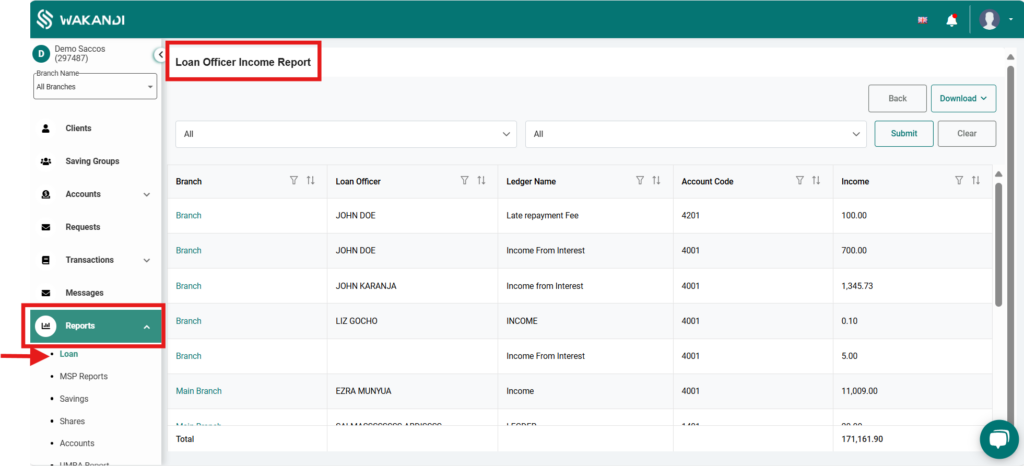

Comprehensive Income Report by Loan Officer and Branch

The detailed income reports, segmented by branch and loan officer, provide branch managers and executives with valuable insights to assess individual loan officer performance. This robust reporting toolkit empowers them to evaluate outcomes and enhance strategic decision-making.

Key Highlights

- Income Breakdown by Branch and Loan Officer

- The report provides total income generated by each branch, segmented further by individual loan officers within the branch.

- Income sources include:

- Interest payments

- Processing fees

- Service charges

- Insurance markups

- Additional loan-related fees

- Detailed and Summary Views

- Summary View: Offers a concise overview of:

- Total income per branch

- Income per loan officer

- Overall total income for the organization

- Detailed View: Delves deeper into:

- Loan-level income under each loan officer

- Individual income components, such as interest and fees

- Summary View: Offers a concise overview of:

How to Access the Report

- Login to the Wakandi Admin Panel.

- Navigate to the side menu and select Reports.

- Under Reports, choose Loan

- Select Loan Officer Income Report to view.

Benefits of This Feature

- Performance Evaluation: Quickly assess how branches and loan officers contribute to revenue.

- Granular Insights: Understand detailed income sources for targeted improvements.

- Strategic Decision-Making: Use data to identify high-performing branches/officers and replicate success strategies across the organization.