Interest Recalculation for Backdated Transactions

Backdated transactions will now trigger an interest recalculation for the upcoming installments, ensuring accurate repayment schedules and interest adjustments for loans running on reducing balance. This is only applicable to loans with reducing balance Interest Rate calculation method.

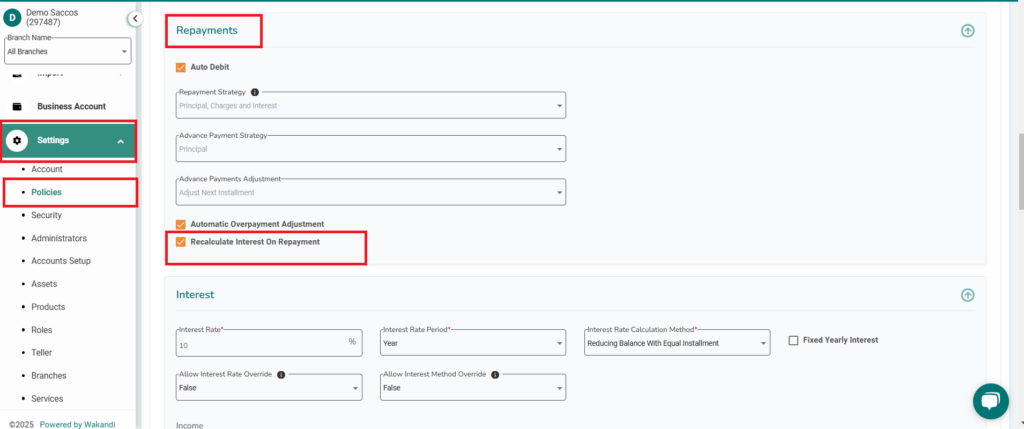

First of all, edit the Credit Product Policy using the below steps

- Open the CPP to be edited

- Under “Repayments” tab, check the field against Recalculate Interest on Repayment

- Submit the CPP and ensure all admins approve it.

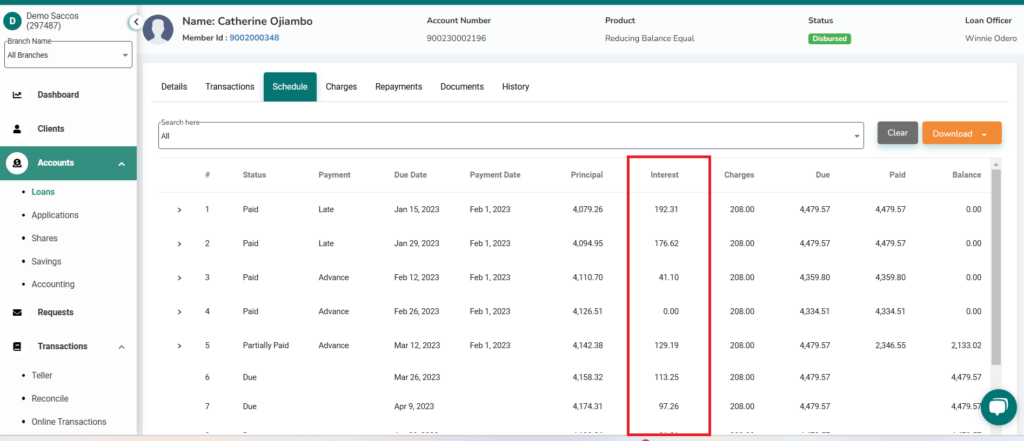

Below is a loan schedule for a loan before making a backdated loan repayment

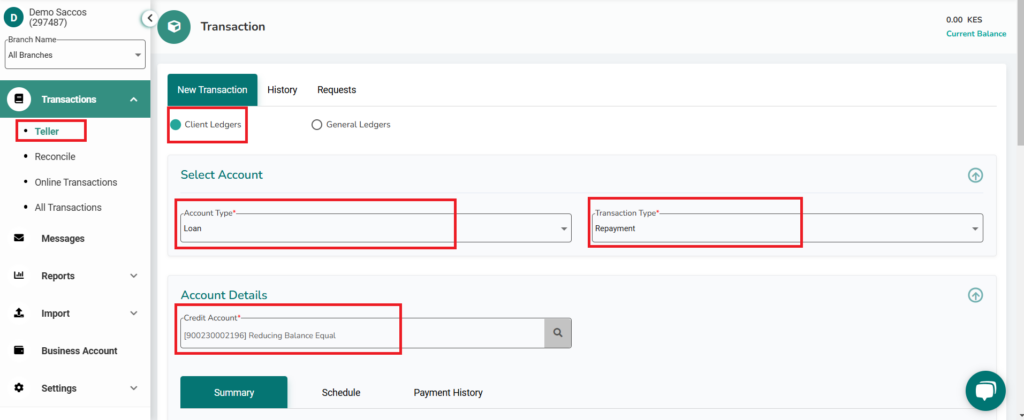

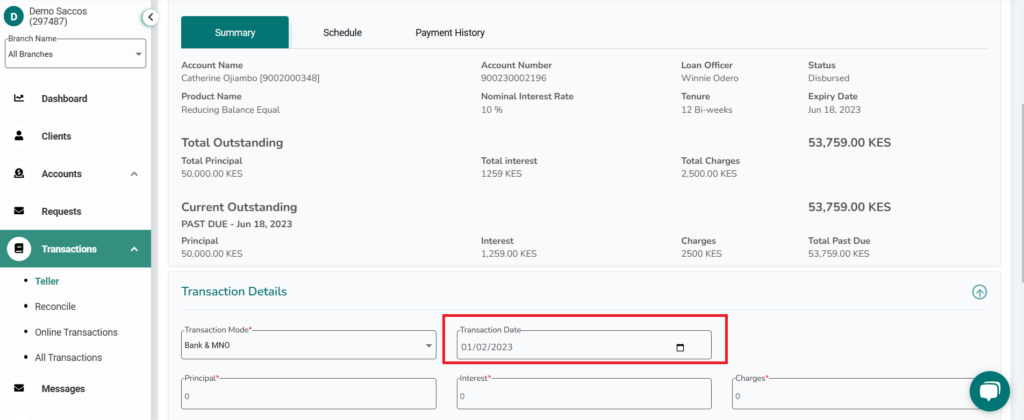

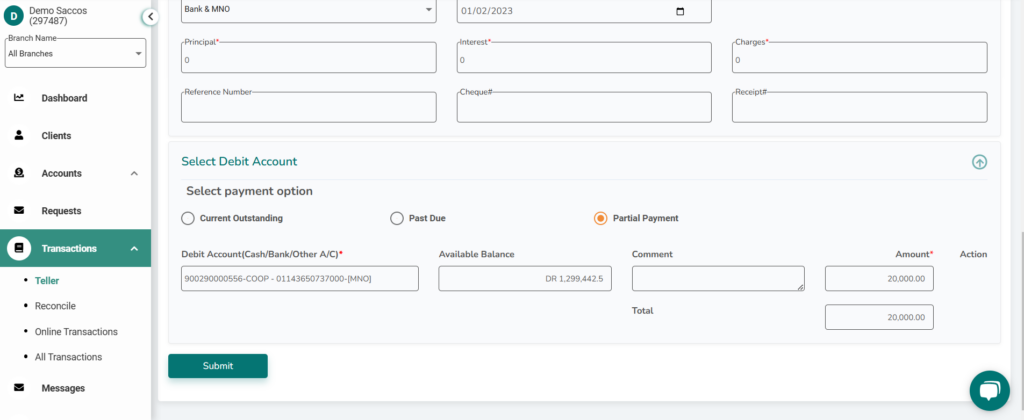

To make the repayment, below are the steps

- Select Transactions the Teller

- Ensure Client Ledgers is checked

- Account type is Loan

- Transaction Type is Repayment

- Account Details is the member’s loan account

Backdate the date under Transaction Date tab

Click on submit to ensure the transaction and ensure the posting is successful

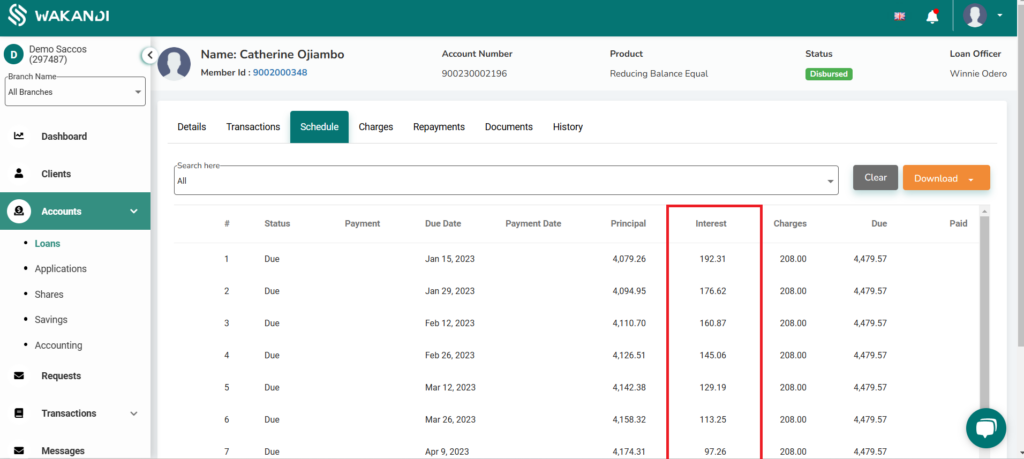

After the loan repayment, notice the interest rate amounts on the schedule have changed as indicated below