Teller Reversal for Loan Transactions

The Teller Reversal feature allows tellers to fully reverse transactions, restoring loan installments to their previous state. This ensures that any erroneous disbursements or repayments can be corrected seamlessly.

Additionally, Concurrent Ledger Updates ensure that accounting ledgers reflect the transaction reversal accurately, maintaining precise financial records throughout the process.

How to Reverse Loan Transactions

Reversing a Loan Disbursement

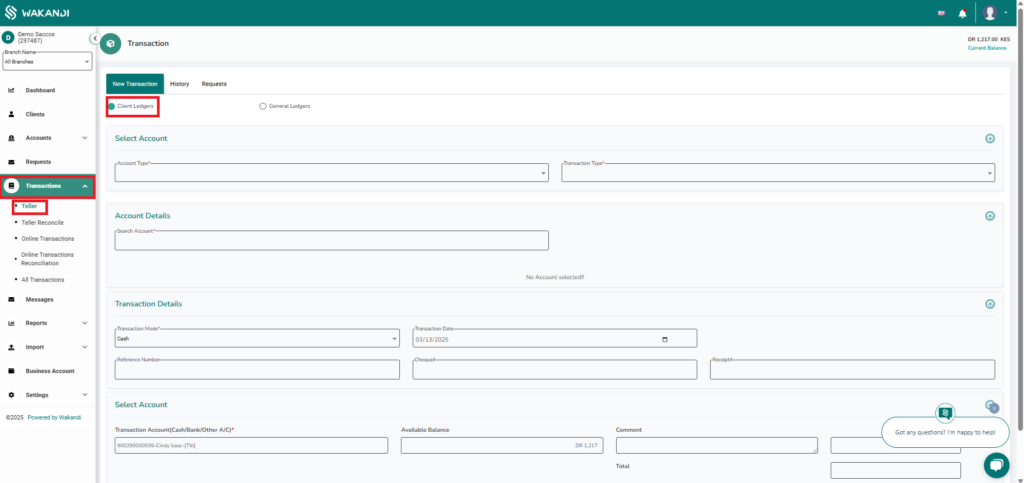

- Log in to CAMS

- Click on Transactions

- Select Teller

- Click on Client Ledgers

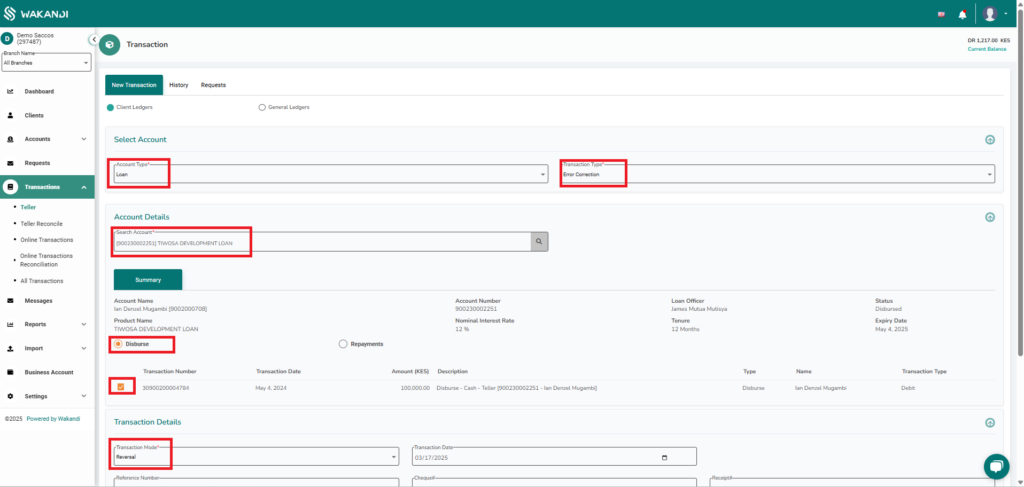

- Under Account Type, select Loan

- Under Transaction Type, select Error Correction

- Enter the loan account number in Account Details

- In Summary, choose Reversal for Disbursement and check the box below it

- Under Transaction Mode, select Reversal

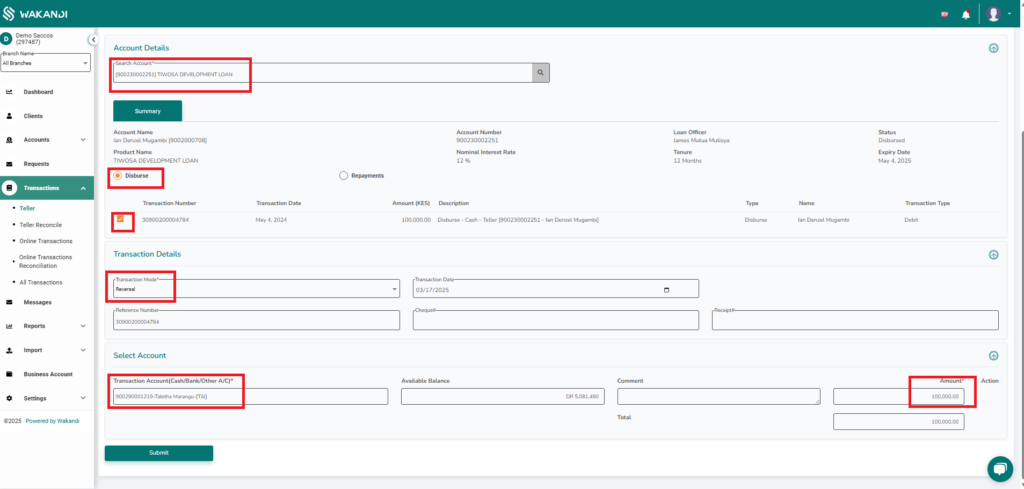

- Select the Bank Account under Transaction Account

- Enter the amount to be reversed and click Submit

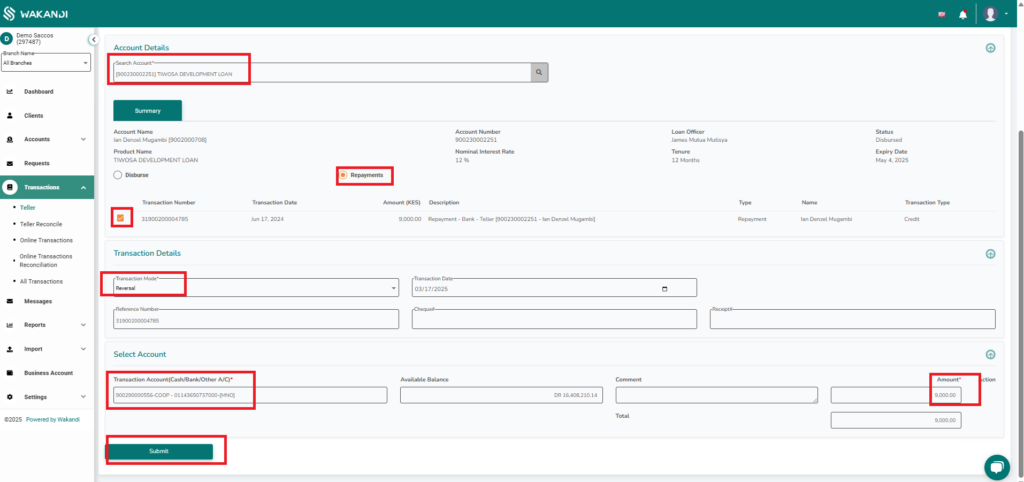

Reversing a Loan Repayment

- Log in to CAMS

- Click on Transactions

- Select Teller

- Click on Client Ledgers

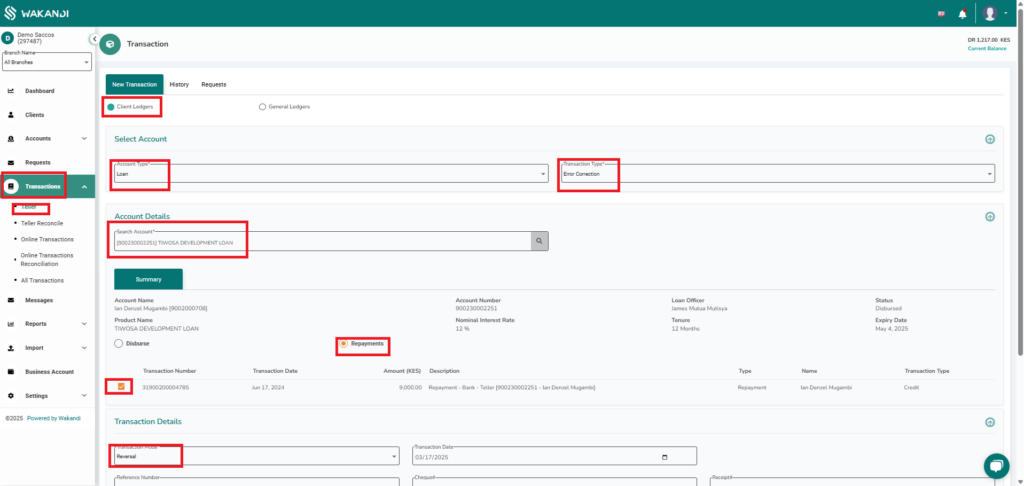

- Under Account Type, select Loan

- Under Transaction Type, select Error Correction

- Enter the loan account number in Account Details

- In Summary, choose Repayments and check the box below it

- Under Transaction Mode, select Reversal

- Select the Bank Account under Transaction Account

- Enter the amount to be reversed and click Submit

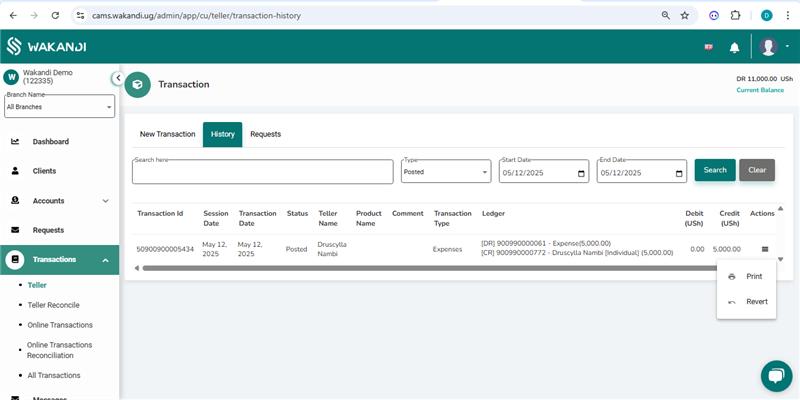

Reversing at Teller History

Besides the above highlighted techniques of reversing different transactions, Wakandi CAMS offers another route to approach this functionality. We can do teller reverse transactions within the transaction history tab. The following steps below guide us on how to execute the functionality of reversing at teller history.

- Log in to CAMS

- Click on Transactions

- Select Teller

- Click on History Tab.

- Search or Filter for transaction of interest.

- Under Actions column, click the icon with 3 parallel lines

- Choose Revert from drop down menu that appears.

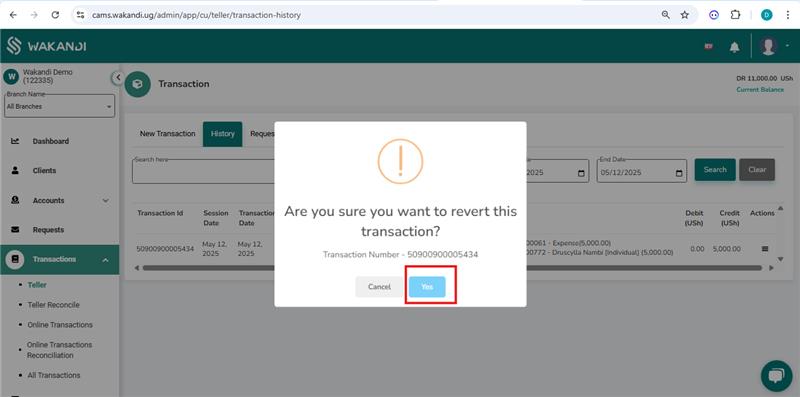

- A confirmation pop up box appears, click Yes.

- Then a notification will appear in green upon successful reversal of transaction.

Key Benefits

✅ Error Correction: Allows tellers to fix incorrect disbursements and repayments easily.

✅ Accurate Financial Records: Ensures ledgers remain consistent and up-to-date.

✅ Seamless Reversal Process: Simplifies transaction corrections with minimal disruptions.