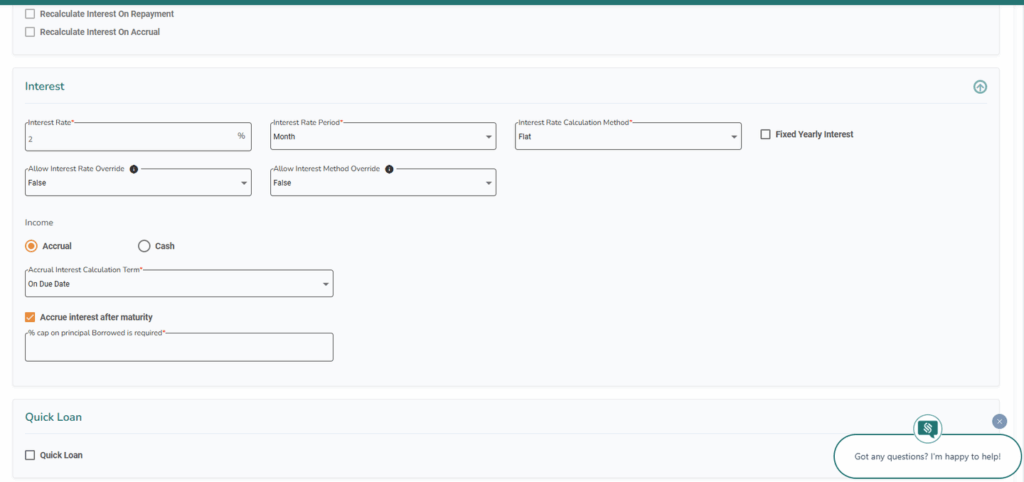

Accrue Interest After Maturity

We are excited to announce a significant enhancement to our Credit Policies: the “Accrue Interest After Maturity” toggle. This new configuration option empowers users to better manage interest accrual on overdue loans, providing more flexibility and control over financial obligations.

Key Features:

- Continued Accrual: Interest accrual persists until the total accrued interest—both paid and unpaid—reaches a specified cap.

- Configurable Cap: The cap is based on a percentage of the original loan principal, allowing for tailored financial management.

Interest Cap Configuration

With this new feature, users can set a maximum interest cap as a percentage of the principal amount. This cap ensures that interest accrual does not exceed a predetermined limit, offering a safety net for both borrowers and lenders.

The maximum Cap is Up to 100% of the loan principal.

Example:

If a borrower has a loan principal of $10,000 and sets the cap to 80%, interest accrual will cease once the total interest (paid + unpaid) reaches $8,000.

Benefits of the New Feature

- Enhanced Control: Lenders can manage risk more effectively by setting interest caps.

- Greater Flexibility: Borrowers have a clearer understanding of potential interest obligations.

- Improved Financial Planning: Both parties can make informed decisions regarding loan management and repayment strategies.