Overdraft Enablement for Current Account

A new enhancement has been introduced to enable Overdraft Functionality for Current-type Saving Products. This upgrade offers greater flexibility for account holders while ensuring financial institutions maintain full oversight and control.

1. Overdraft Functionality for Current Account Products

Institutions can now enable Overdraft on current accounts during product setup. This is done by selecting the “Enable Overdraft” checkbox when configuring the saving product.

Once enabled:

- Minimum balance validation is removed.

- Accounts can go into a negative balance, up to the approved limit.

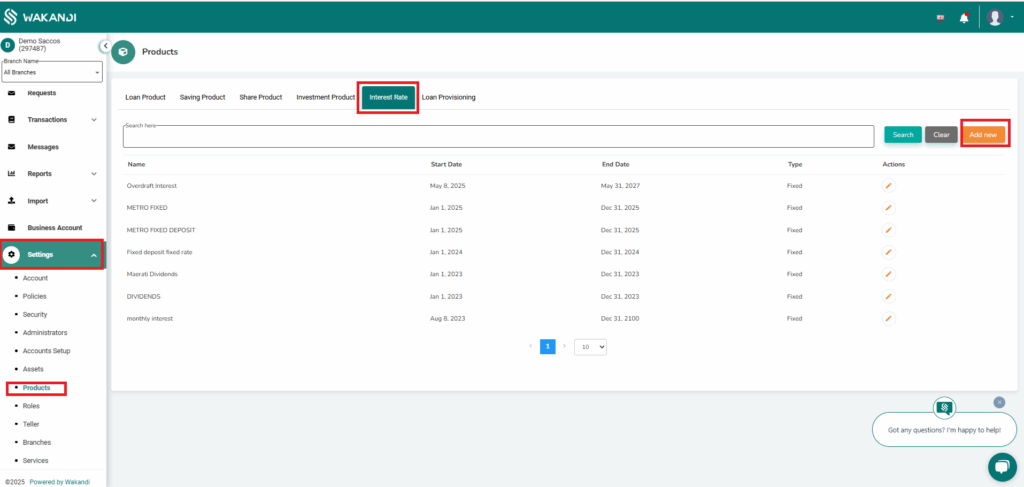

Navigation path :🔍 Go to:

- Settings

- Product

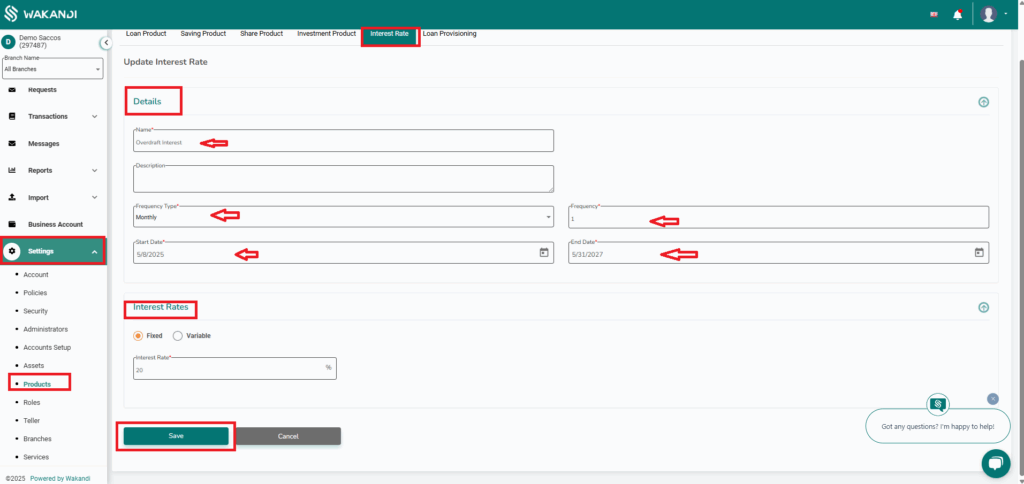

- Select “Interest Rate”

- Click on “Add New”

- Key in the “Details” and “Interest Rate” then “Save”

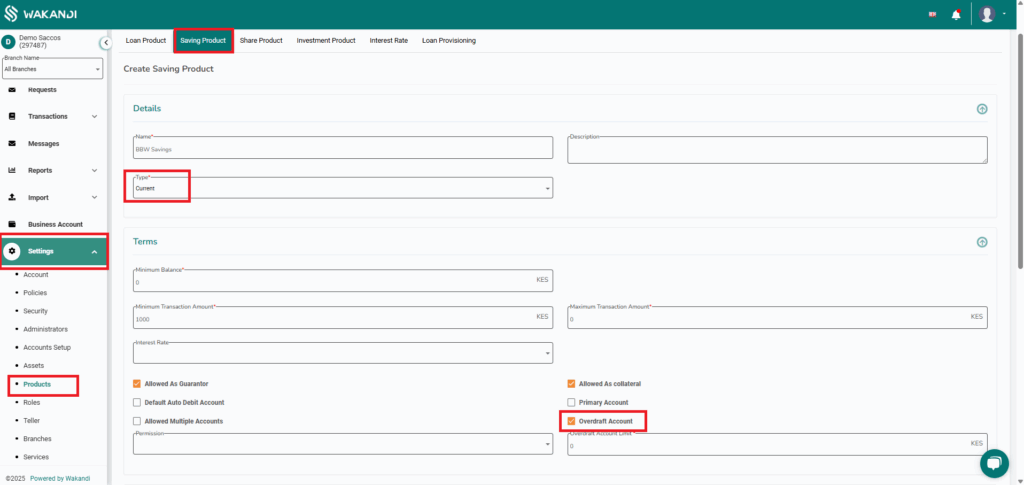

- Saving Product

- Select Type: “Current”

- Click on the “Overdraft Account” to enable

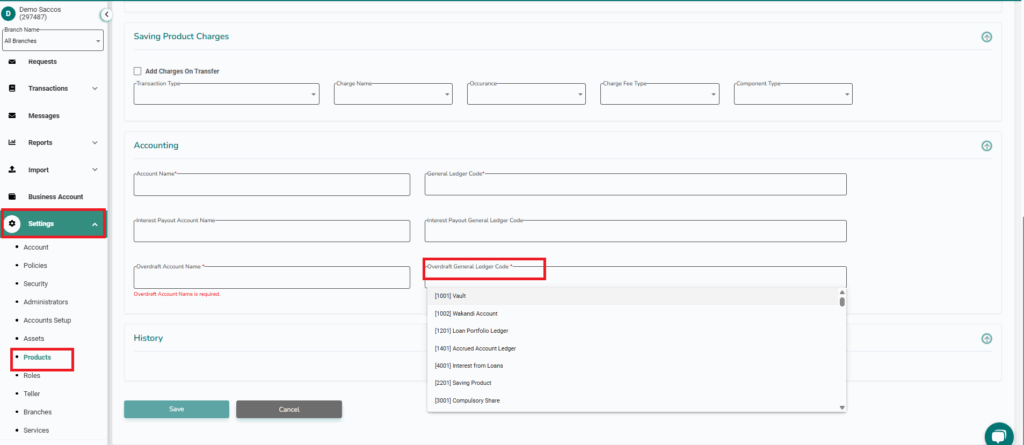

- Select the “Overdraft General Ledger Code”

2. Maximum Overdraft Limit

A Maximum Overdraft Limit can now be configured to control the allowable negative balance on an account.

How It Works:

- The system first deducts funds from the main account balance.

- If the main balance is insufficient, the system utilizes the overdraft balance.

- If the withdrawal exceeds the overdraft limit, the transaction is blocked, and a validation message is shown.

This feature ensures transactions stay within the approved overdraft threshold.

3. Overdraft Accounting Enhancements

To support this feature, a dedicated Overdraft Control Account (Ledger) has been introduced. This ensures all overdraft activity is accurately recorded and separated from regular transactions.

Accounting Logic:

| Scenario | GL Code Used |

|---|---|

| Transaction amount < Main balance | Regular GL code |

| Transaction amount = Main balance | Regular GL code |

| Transaction amount > Main balance | Split between Regular GL and Overdraft GL |

This split ensures clear tracking of funds sourced from both the main balance and overdraft allowance.

Summary

The new overdraft functionality for Current Accounts includes:

- Seamless configuration through product setup.

- Controlled overdraft with customizable limits.

- Enhanced accounting with accurate ledger tracking.

This update empowers institutions to offer more flexible services, improve customer satisfaction, and maintain strong financial governance.