What is Wakandi Business Account?

WBA is a billing and payment method for the Wakandi system.

Wakandi Business Account (WBA)

The Wakandi business account is a new portal for more straightforward billing and payment methods for the Wakandi system. You can view all your entries from the business account using the Wakandi system, giving you total visibility.

How to top up the WBA

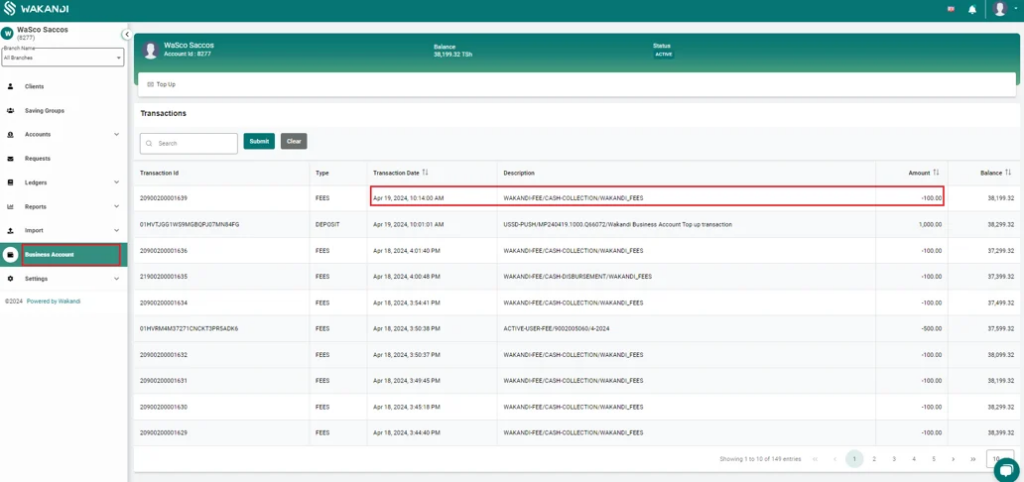

Example of fee deduction

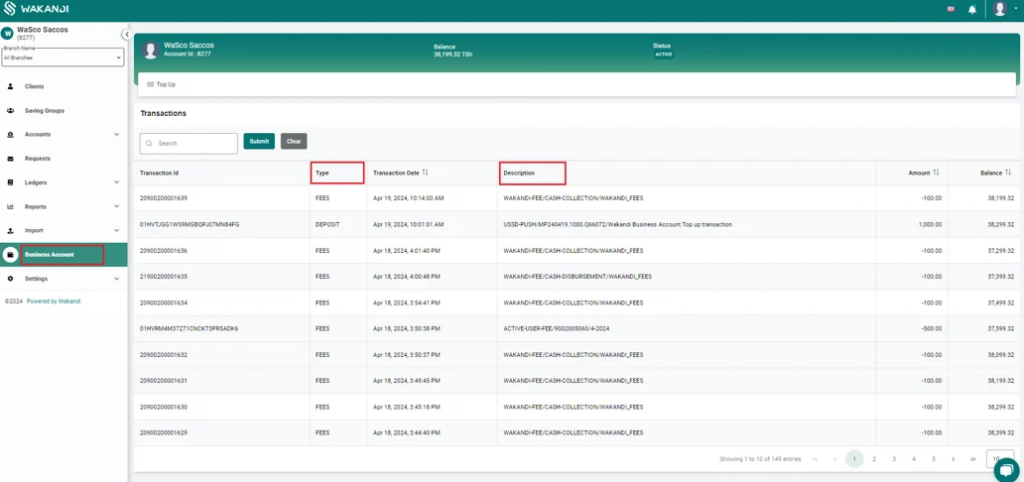

What you will be able to see on the Business Account

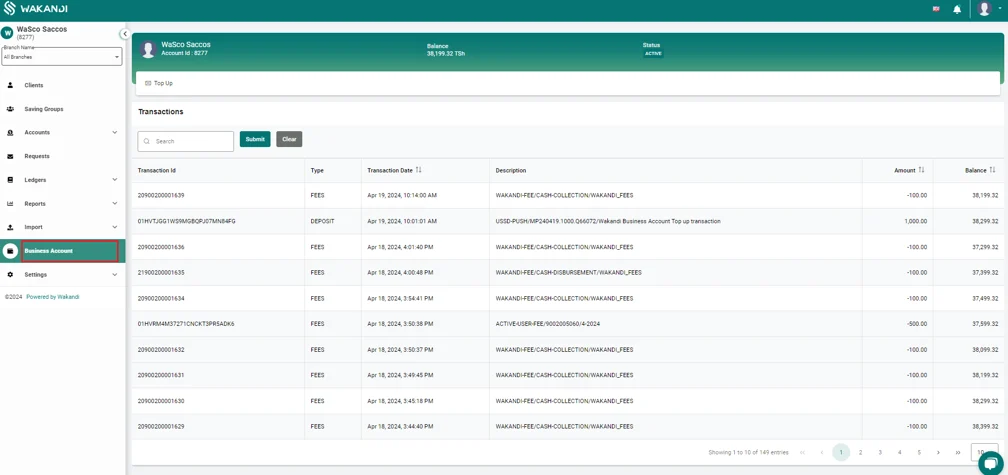

1. Log in to Wakandi CAMS

2. Click on Business Account from the sidebar menu.

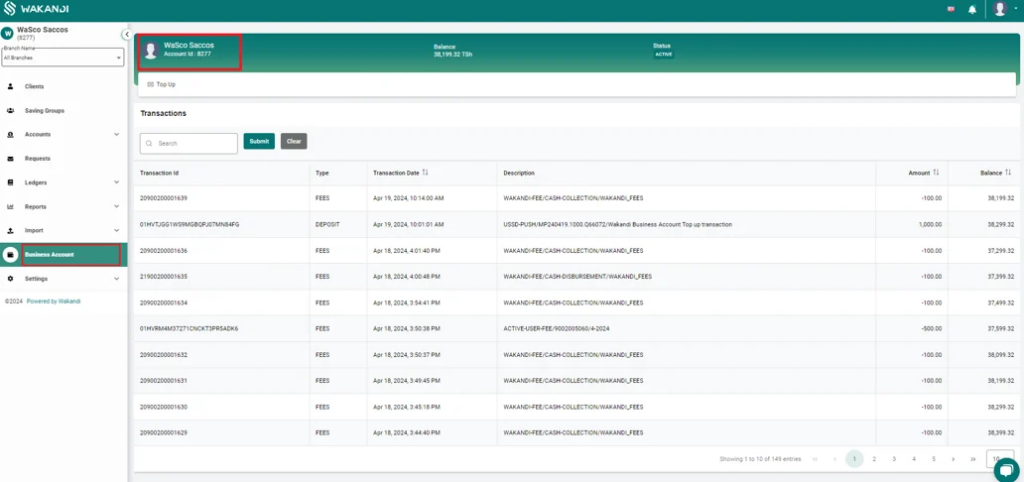

What are the different types?

The Types give you visibility on the entry passed by a specific transaction made.

- Fees

- Fees: These fees are charged to Sacco on the Wakandi business account.

- Wakandi Fee: This is a fee for cash and online transactions.

- Active User Fee

- Deposit: This is a deposit or “Top-up” transaction to the Wakandi business account.

- Collection: This is an online deposit transaction made to the Sacco by the member.

- Payment: This is a payment transaction made from the Wakandi business account. This includes Sanlam premium insurance fees.

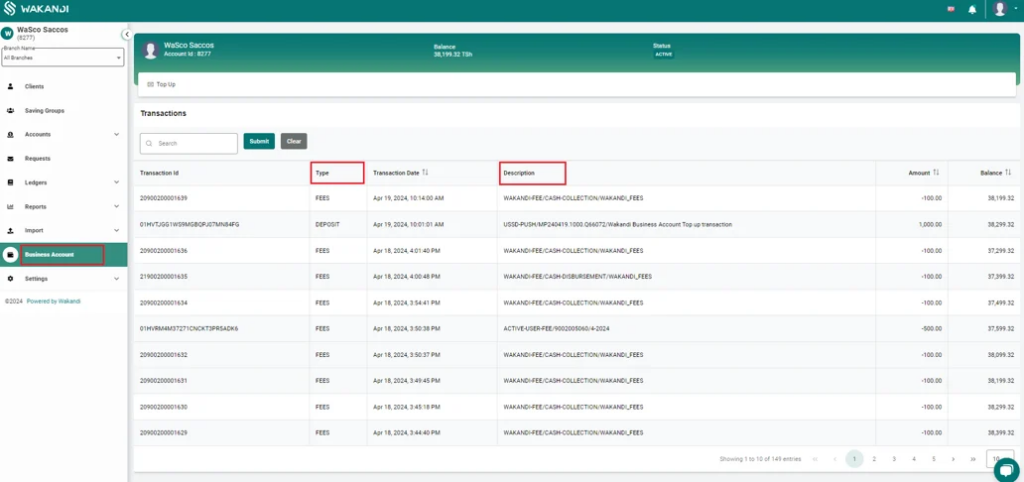

What are the different types?

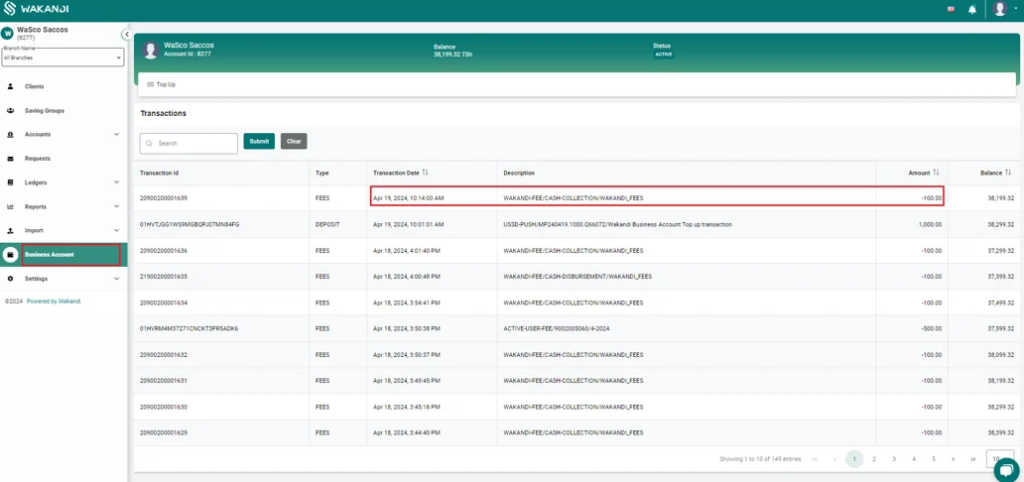

The Descriptions give you further details on the particular transaction.

- Wakandi-fee/Cash collection – This describes a fee collected for Cash deposits and repayments that occur over the counter made to Sacco.

- Wakandi-fee/Cash disbursement – This describes a fee collected for Cash disbursements over the counter.

- Active-User-Fee – This is a fee charged once a month for an active member within a specific month.

- Ussd-Push – This indicates that the tranasaction was initiated by a push service from admin app or member app.

- Sanlam Insurance – This is the fee charged on loan disbursement as a Sanlam premium insurance fee.

- Ussd-direct – This describes transactions that are initiated through Ussd menus.

What is the amount and balance, and how it works?

On the Wakandi business account, you have total visibility of all the transactions, which is seen in the amount column. This field shows the amount paid or deposited from the Wakandi business account. This amount updates the balance depending on the type of entry made; it is all sorted in the newest to oldest(descending) order.

Once a transaction is recorded, the entry is also made on the business account, which deducts from the available balance and displays the current balance after the deduction is made inside the row.

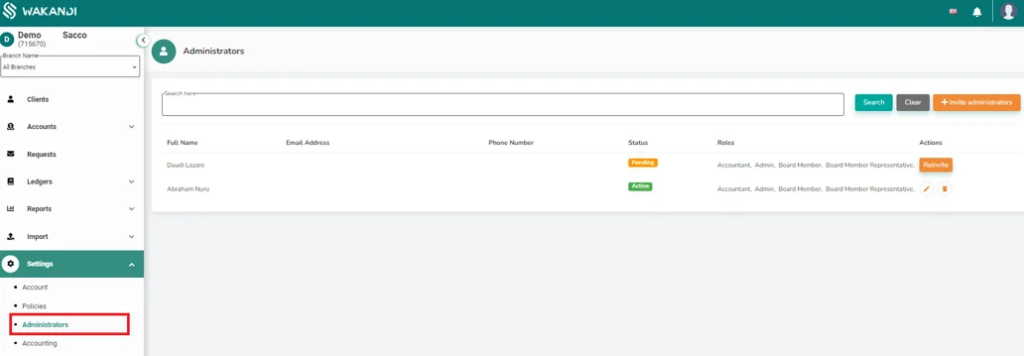

Who has access to the Wakandi business account?

By default, the main admin has access to the Wakandi business account and can perform Top-up transactions; any other admin will have to be granted access by the admin. To do so, the admin will have to do the following.

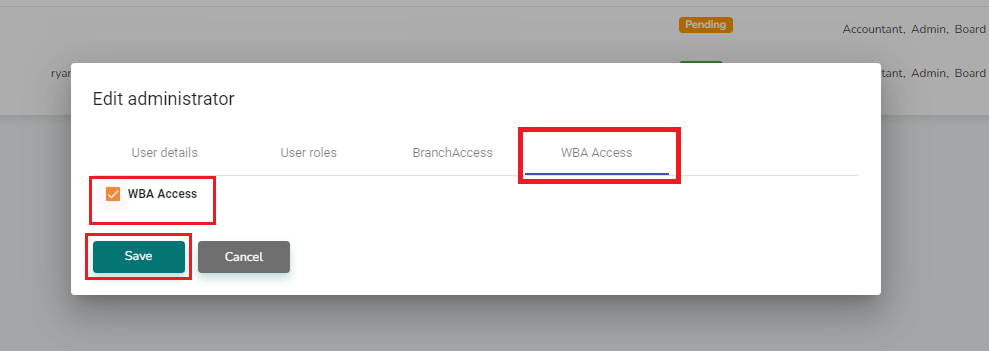

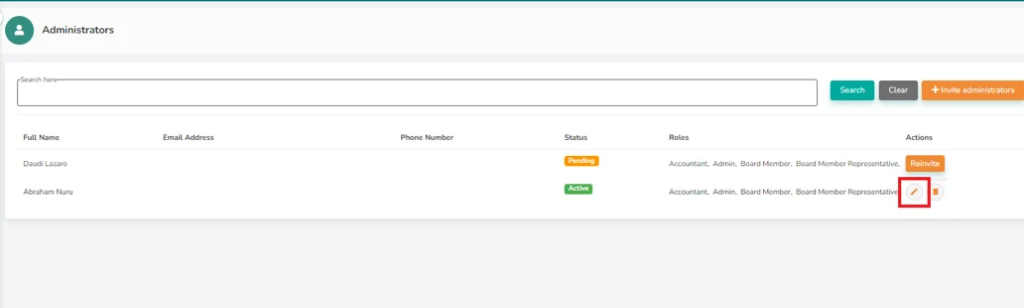

1. Navigate to settings and click on Administrators…

2. Select edit on admin you want to grant access.

3. On the menu options, select WBA access..

4. Check the box on WBA Access.

5. Click Save.