Corporate Tax Payment & Ledger Posting

Overview

Users can post Corporate Tax payments in the Wakandi CAMS system, with automatic posting of account notes in tax ledgers for accurate and efficient tax record management.

Corporate tax is a government-imposed tax on company profits. In CAMS, it helps track tax payments and ensures accurate ledger entries.

Setting Up Corporate Tax in CAMS

Before posting corporate tax, you must first create:

- Accounts Payable Ledger – Tracks tax owed but not yet paid.

- Prepaid Corporate Tax Ledger – Records tax paid in advance as an asset.

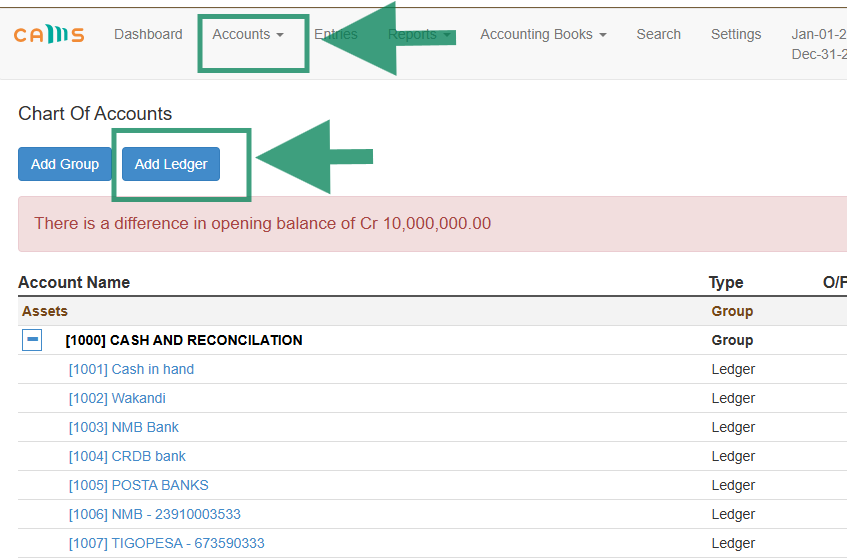

Steps to Create Ledgers

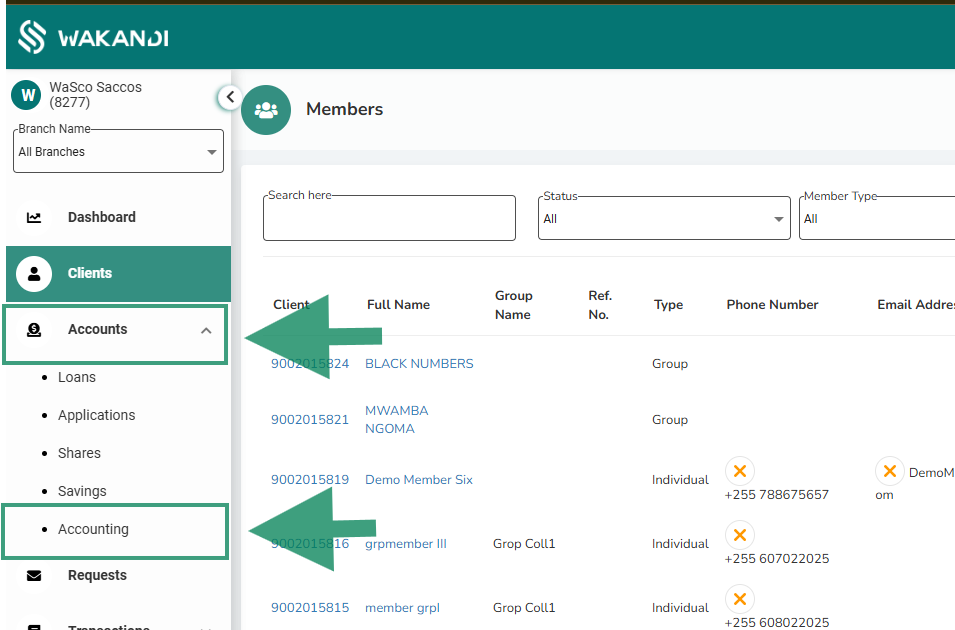

- Login to CAMS → Go to Accounts → Accounting→ Go to Accounts

- Click “Add Ledger”, then create Accounts Payable and Prepaid Corporate Tax.

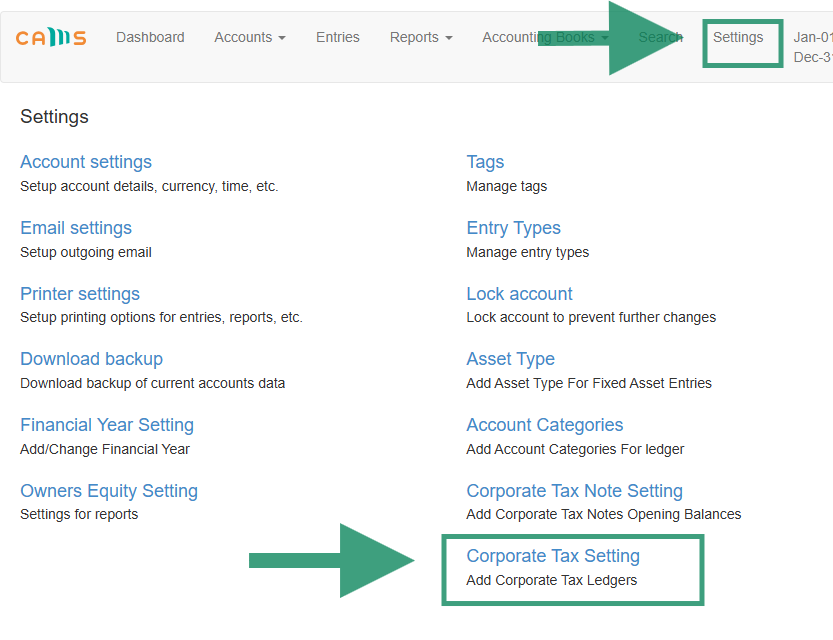

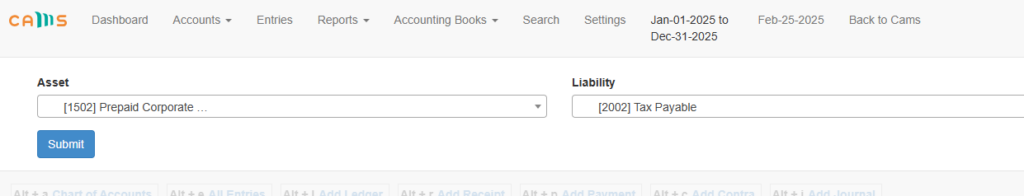

The second step is Configuring Corporate Tax in the System

After creating the Accounts Payable ledger, you can proceed with configuring Corporate Tax in the system by following these steps:

Follow these steps to configure corporate tax in CAMS:

- Navigate to Cams – Go to Account then Accounting

- You will navigate to Settings Then you will select Corporate Tax Setting

- After opening Corporate Tax Setting the page will open and it will give you options to inter the ledger of Accounts Payable and Prepaid Corporate Tax through which Tax Payable will be going to liabilities Prepaid corporate tax will be going to Assets

Then you will click submit and the account will be created. After that, you can continue with Corporate Tax Note Setting creation

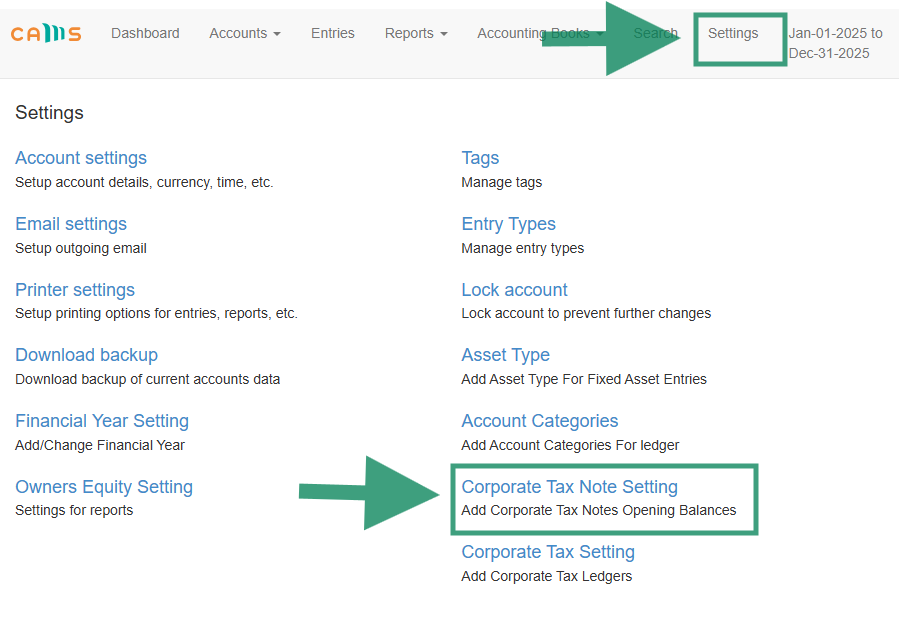

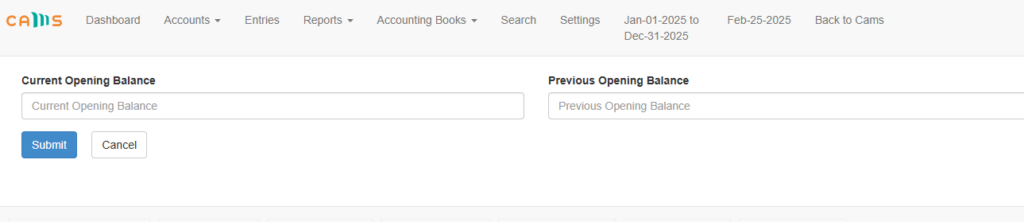

The third step is corporate tax Note Setting

Is a process that involves configuring the opening balance for the regulatory authority in the system. This helps to adjust previous owed tax and the current tax to be paid

This step configures the opening balance for the regulatory authority:

- If the authority owes you, enter a positive balance (receivable).

- If you owe the authority, enter a negative balance (payable).

Steps to Configure Corporate Tax Note Setting:

- Go to Settings → Select Corporate Tax Note Setting.

- Enter the Opening Balance (Positive if the authority owes you, Negative if you owe them).

- Save the settings to update the tax records.

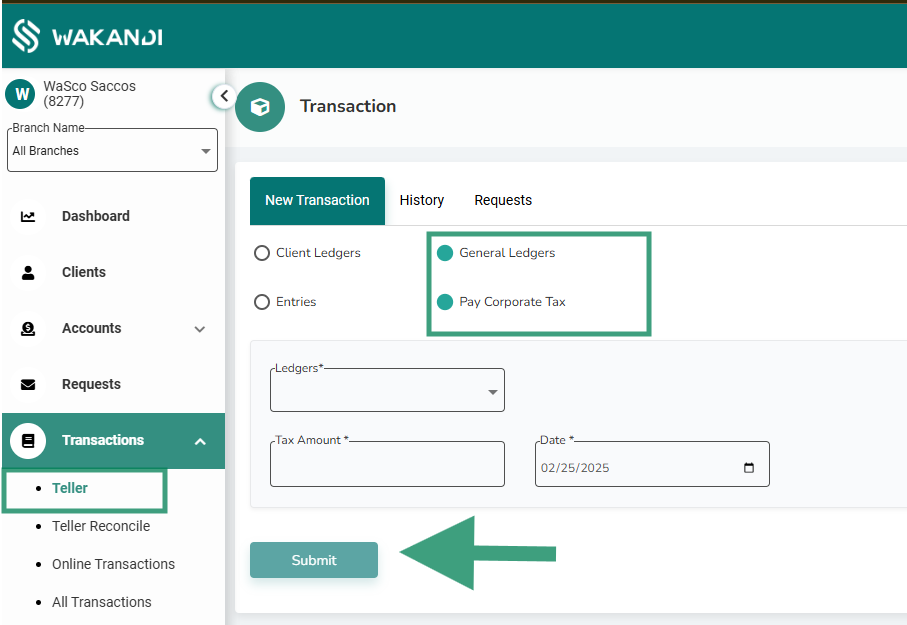

The last step is Posting Corporate Tax Payments

The steps for posting Corporate Tax Payments in the system:

- Login to CAMS → Go to Transactions → Teller.

- Select General Ledger → Choose Payable Corporate Tax.

- Pick a ledger (Cash in Hand or Bank).

- Enter the Tax Amount and Transaction Date.

- Review and Post the Payment.

Once completed, the system records the transaction, ensuring proper tax management and compliance.