Flexible Loan Guarantor Options

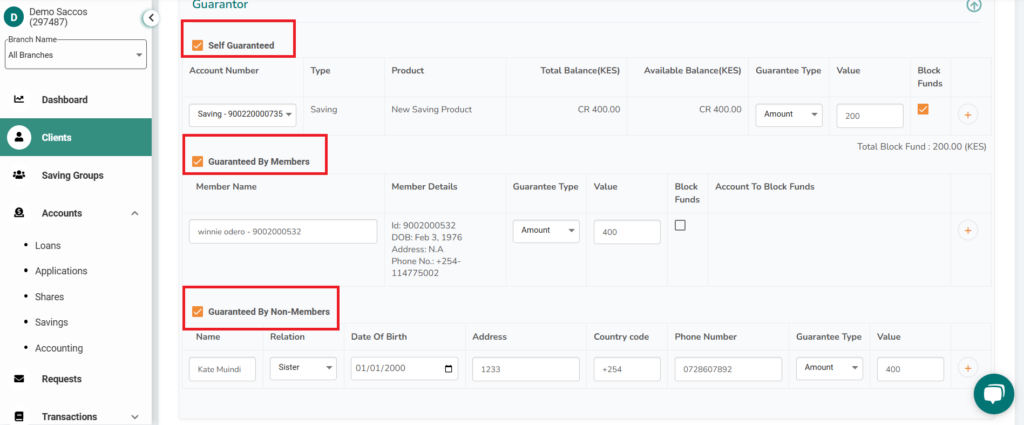

This feature that allows users—both admins and members—to combine self-guarantors (loan owners), member guarantors, and collateral during loan creation. This added flexibility simplifies loan guarantee management while offering members more options to secure their loans.

Key Scenarios for Implementation:

- Loan Application by Admin on Behalf of the Member:

- Admins can incorporate flexible guarantor options directly during the loan application process.

- Loan Approval by Admin:

- During loan approval, admins can edit guarantor details to reflect the agreed-upon arrangements.

Setting Up Flexible Guarantor Options:

- Step 1: Update the Credit Product Policy (CPP):

- Ensure the types of guarantors approved by the board are reflected in the policy.

- The CPP must be approved by admins before changes take effect.

- Step 2: Loan Application Process:

- Members can apportion guarantors, selecting a combination of self-guarantors, member guarantors, and collateral as per the updated CPP.

This feature empowers organizations to tailor loan guarantees based on their unique needs, enhancing member satisfaction and operational efficiency.