Loan Risk Classification

Overview

The system supports configurable Loan Risk Classification within the Credit Policy, enabling the financial institution to define and customize risk management criteria based on their policies. This feature allows institution to classify loans according to risk levels, ensuring a more tailored approach to loan provisioning and compliance. By setting specific risk parameters, the credit institution can align their credit assessment process with internal policies, enhancing financial stability and decision-making.

Steps to Configure Loan Risk Classification

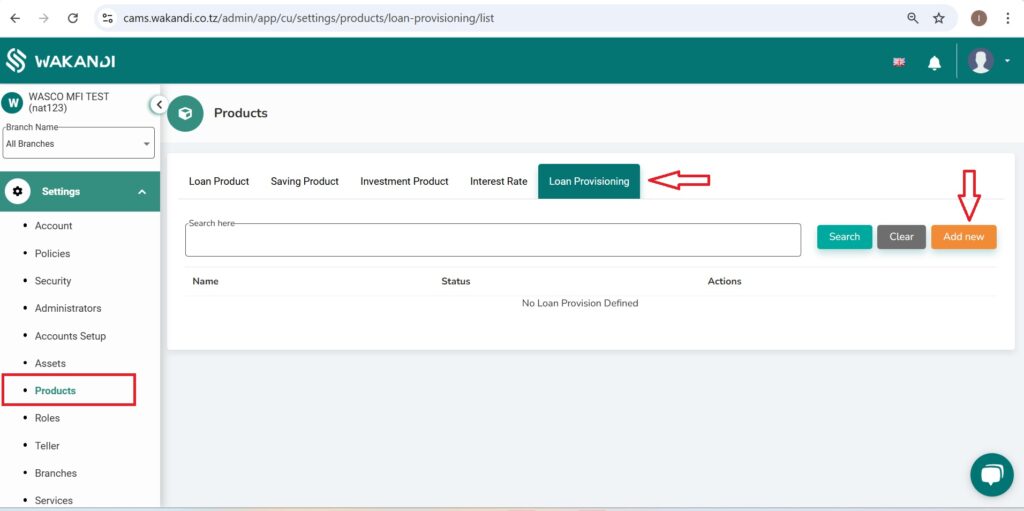

- Access the Menu – Click the Settings button.

- Navigate to Loan Provisioning – Select the Product button, then click Loan Provision and choose Add New.

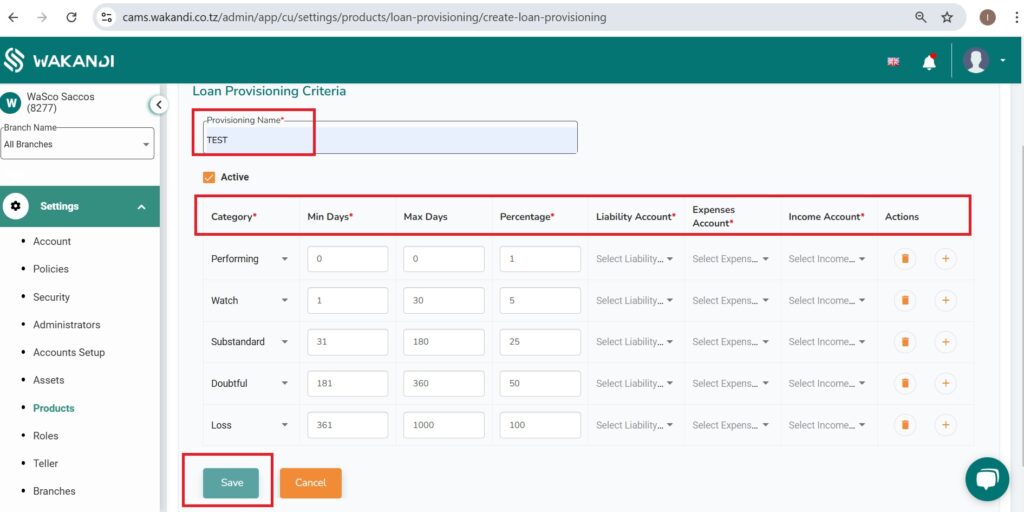

- Define Provisioning Rule – Enter the Provision Name and tick the box to make it Active.

- Set Classification Criteria – Select:

- Category

- Min Days & Max Days

- Provisioning Percentage

- Expense Account & Income Account

- Add New Classification – Click the + button under Actions.

- Complete & Save – Fill in the required fields and click Save.

This allows institution to customize loan provisioning rules and align risk management with internal policies.