Quick Loans Product

This feature allows eligible members to apply for and receive loans instantly, providing fast and convenient access to funds. The admin can amend an existing loan policy to a quick loan or set up an entirely new loan with a chosen name. Popular names are Mobile loan, Instant loan, Chap chap among others. The convenience fee for this loan is 2%.

Key Features:

- Instant Loan Application: Members can apply for a quick loan directly from the Member App or the ussd.

- Eligibility Criteria: Loans will be granted based on pre-defined eligibility criteria.

- Instant Disbursement: Once approved, the loan amount will be disbursed instantly to the member’s MNO account.

- MNO Account Matching: The MNO account number must match the member’s registered phone number.

- Consistent Repayment Process: The repayment process for quick loans will follow the same procedure as regular loan products.

Why choose Quick Loan

1. Easy to access via App or USSD.

2. Fast approval and disbursement process.

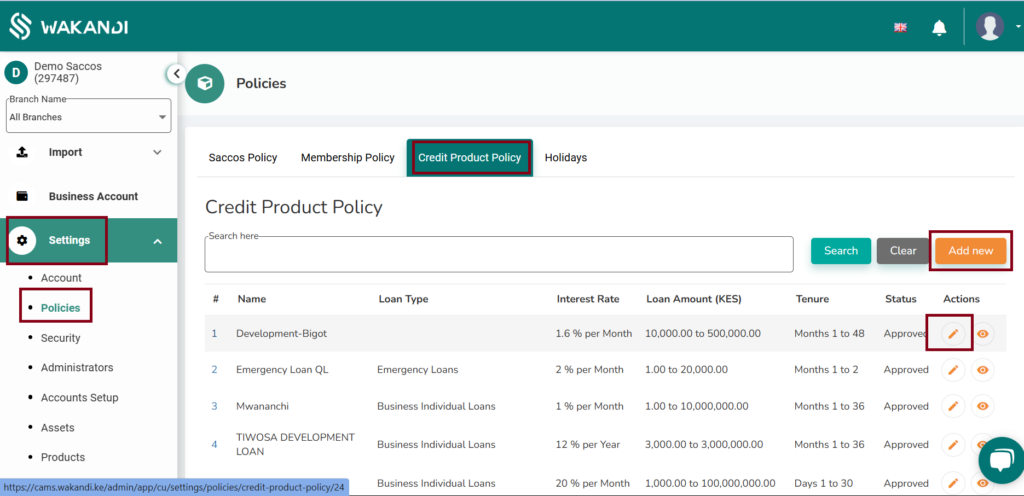

Steps to set up Credit Product Policy of a Quick Loan:

1. Go to settings click on policies then credit product policy.

2. Click on “Add New” if you want to create a new loan policy for quick loan.

3. A quick loan can also be amended to an existing loan policy by simply editing the policy.

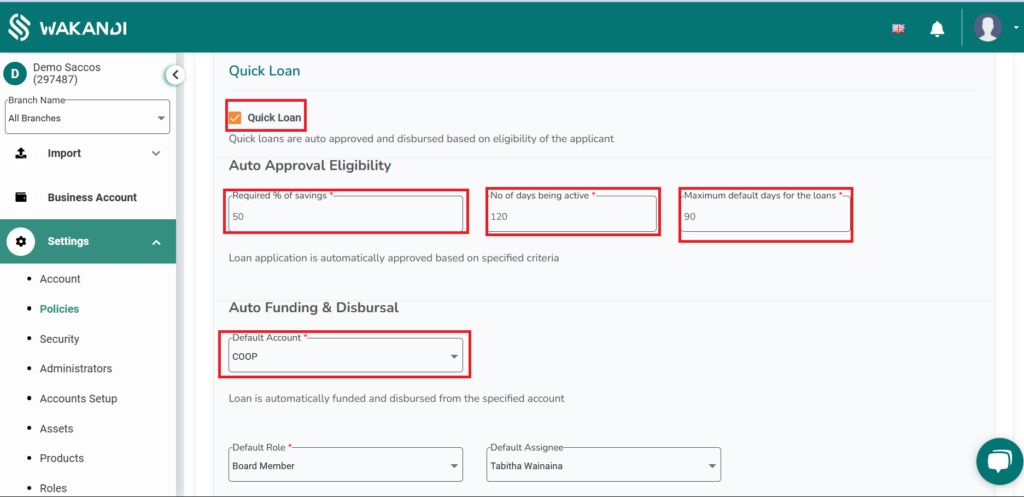

4. Scroll down to where it is writen Quick loan make sure it is marked as shown below.

What to set under Quick Loan

- 1. Eligibility Criteria: Required percentage savings, Number of days the member has to have been active and Maximum default days for existing loans.

- 2. Auto funding and Disbursal: Here you are required to add the default account where the money being disbursed will come from and default role and assignee. After filling in all the required parts submit and make sure that the policy is approved.